Batangas City Real Property Tax Online Payment

In the midst of pandemic, different types of payment solutions arise and some business even the LGU really grab the opportunity to switch to online payment facility to ease exposure and convenience of paying dues on time.

Last year, I was able to pay our Real Property Tax via GCash but I communicated through email and phone call. I was able to talk to a staff and my payment process was convenient that I didn't have to go to the City Hall to pay for our dues. I even receive a copy of my payment and advice me to pickup the official receipt anytime.

Today. I am going to show you how to pay your Real Property Tax Online via Batangas City Online Services.

1. First step is to visit: http://www.batangascity.gov.ph/web/

You will see the image like picture below. You need to click it and it will redirect you to another site: https://business.batangascity.gov.ph/Batangas/OnlineServices/login

2. Since this is our first time to use the Online Services, we need to SIGN UP for an account. This will help us view our accounts and will be easy for us to view other online services that Batangas City offers. Click SIGN UP button.

3. For Data Privacy Consent, click AGREE. This will gather information details necessary for us to view our account that will be needed in our payment for Real Property Tax.

4. You are going to supply your information in the form provided. Click SUBMIT when you are done. Make sure to use a valid and active email for confirmation of your registration and for easy access of the notifications if there is any.

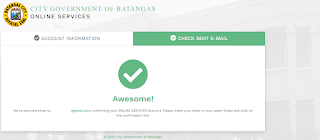

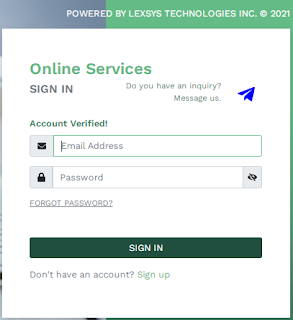

5. Check your email and confirm your registration. If you cannot see the sign up confirmation email at your inbox, you may also check your Spam folder. Click VERIFY MY ACCOUNT button and it should redirect you again to the login page similar to Step 2 but with a message "Account Verified".

6. Login with your details and it will open a dashboard of the Online Services.

There are two options available:

- Business Permits & Licensing Office - New and Renewal of Business

- City Treasurer's Office - Real Property Tax

Since we are going to pay for the Real Property Tax, click the button for the RPT.

7. A popup will appear and it will ask you to register your Real Property Unit First. Click OK and click REGISTER REAL PROPERTY UNIT button.

You need to have a copy of your RPT from previous payment. If you are not sure about the details kindly request for a copy first through the City Treasurer to avoid wrong payment details of your RPT.

8. Enter the details in form below and click SAVE to view your Real Property Unit with details of Tax Declaration Number, RPT Account Number, PIN, Declared Owner Name, Kind/Class, Assessed Value, and Last OR Number & Date.

9. Once you are done enrolling your Real Property Unit(s), you can now click the COMPUTE REAL PROPERY TAX button bellow the dashboard.

10. Your Billing details will be generated and you can see the amount you needed to pay per quarter or for the whole year. Click PROCEED TO CHECKOUT button below the Billing Details table.

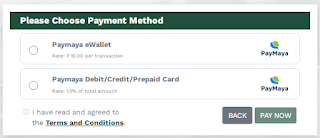

11. Payment options available and charge fees are as follows. Click PAY now to continue.

Post a Comment

4 Comments

Hi! I tried registering kaso di kumakagat ung sa tax dec part. Pwede po ba malaman how you did your input sa site? Thank you!

ReplyDeleteSorry for the late reply. Are you referring to Step #8? Since D is already in the first Box I just input the succeeding numbers as follow just supply your Tax Dec Number for example my tax dec number is D-111-11111: 2nd box "111" and 3rd box "11111" then I leave the last box blank. Hope this helps. You can also reach me through my facebook page wanderwahm for faster reply. Thank you

DeleteThank you for this self help guide!

ReplyDeleteSigning up to their website does not work at the moment

ReplyDeleteThank you for reading my blog posts. You may also reach out on my Facebook page.